Chinese Aggression + Strong US JOBS - Market Notes 08/08/22

- Why is USA so Friendly with Taiwan all of a Sudden?

- China Economy Insight

- Strong US Jobs Data

Nancy Pelosi’s recent trip to Taiwan is not about maintaining democracy for the South China Sea nation but about preventing key technology industry from falling into the hands of China.

See details here which does a good job of summarizing the issue:

https://www.zerohedge.com/technology/unthinkable-us-china-crisis

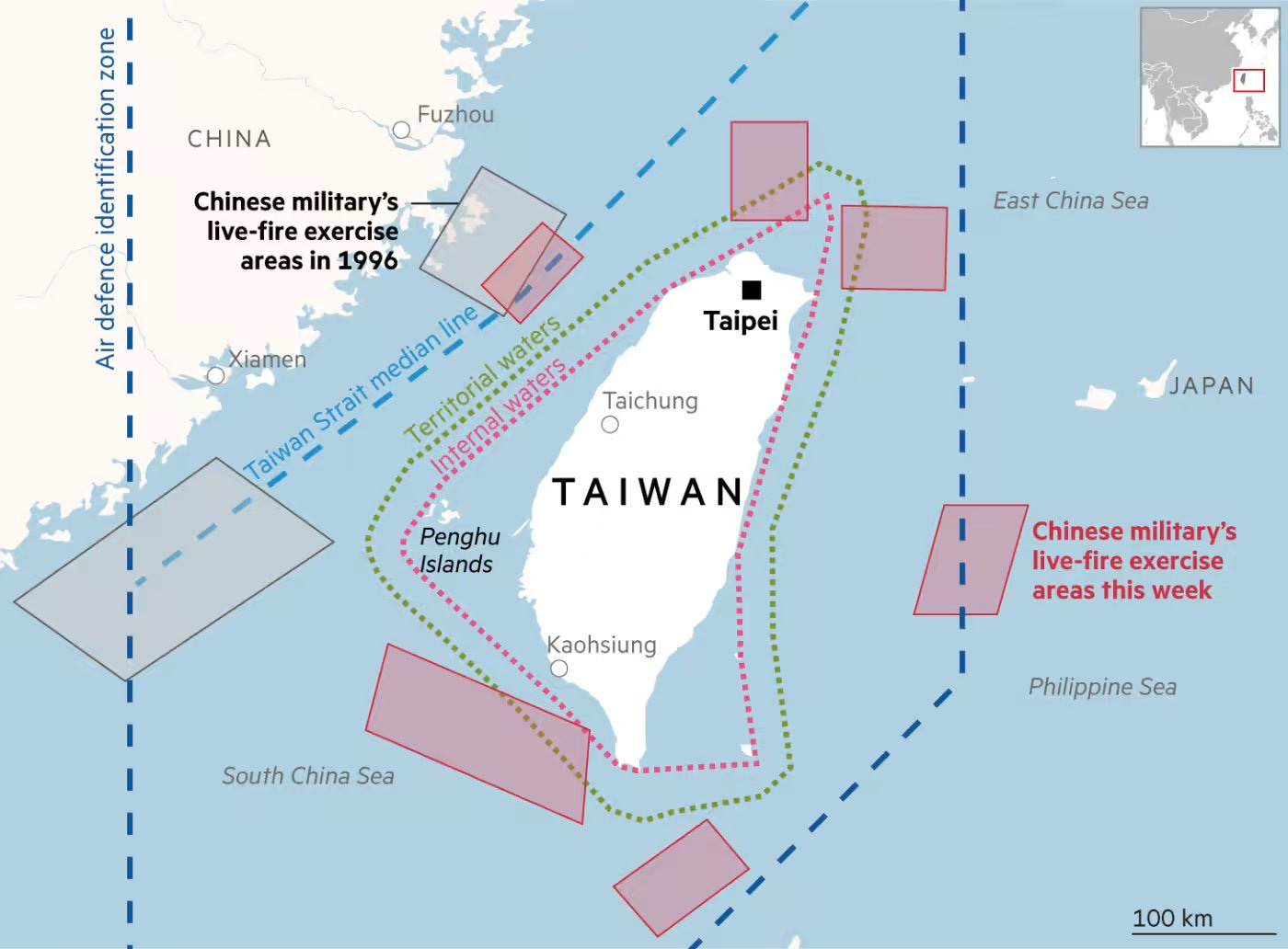

China Extends Military Exercises Near Taiwan With New Drills

Muddy Waters: ‘Maybe I’m missing something, but these simulations seem like an intelligence goldmine for the U.S., Taiwan, and allies. This whole impetuous outburst seems strategically very disadvantageous to China.’

While the West can gain from observing Chinese military forces, I think the deliberate nature of these live fire drills is to highlight Chinese prowess to the world and to act as a deterrent to future bilateral engagement between Taiwan and US/ The West.

My base case is a conflict with Taiwan is still a last resort option for China as their struggling economy would most likely face a significant sanction backlash from Western nations, further isolating the world’s second largest economy from trade and growth.

My thoughts are Chinas preferred strategy is one of slow assimilation for Taiwan in a similar fashion to Hong Kong’s integration.

Zero-Covid Insight:

The world has moved on from Covid but not in China!

This stubbornness of the CCP over Zero-Covid is causing a host of prolonged problems throughout the Chinese economy from reduced foreign direct investment and a prolonged level of low consumer confidence.

India Seeks to Oust China Firms From Sub-$150 Phone Market:

This comes as a blow to Chinese companies such as Xiaomi. India has banned more than 300 apps, including Tencent Holdings Ltd.’s WeChat and ByteDance Ltd.’s TikTok since last year when relations between the two populous nations was damaged over Himalayan border skirmishes. I wonder if the USA had a role to play in influencing India’s technology moves here. Huawei has equally been banned by India and follows on from the US and UK excluding the company from involvement in 5G national infrastructure roll-out which is seen as a highly sensitive market. De-globalization and a movement away from Chinese technology infrastructure continues to be a theme as distrust grows in China’s intellectual property infringement and espionage agenda.

Fed Policy:

75 bps hike now seems more likely after a very strong NFP (Non-Farm Payrolls) number last Friday (528k actual vs 250k survey). Good news on labor statistics is bad news on hikes but shows economy is still healthy and calls for recession are premature.

San Francisco Fed President Mary Daly said the US central bank is “far from done yet” in bringing down price pressures. Governor Michelle Bowman said the Fed should keep considering large hikes similar to the 75 basis-point increase approved last month until inflation meaningfully declines.

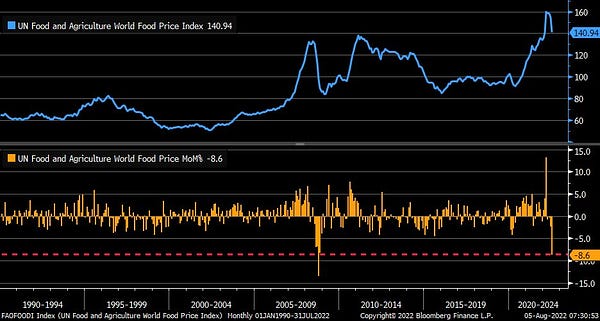

Despite talk of another 75bps hike in September inflation expectations (NY FED) and food prices are already starting to trend down:

Major decline in global food prices should also impact CPI on Wednesday.

Even if the number is slightly down indicating peak inflation, I would think Jerome Powell sticks to 75bps hike in the hope of seeing a downward trend develop, especially while labor remains strong.

Inflation Reduction Act:

The act passed by the senate has many sections to unpack from fighting inflation to climate change to taxation. Some major points below: (more detail to follow)

Incentives like a $4,000 tax credit for the purchase of used EVs, and $7,500 for new ones, will drive up interest in companies like Tesla (TSLA) and Ford (F) that are assembling vehicles in the U.S.

The bill will impose a 15% corporate minimum tax on large corporations - some of which report significant profits but pay little or nothing in income taxes due to credits and deductions - such as Amazon (AMZN), Nike (NKE) and FedEx (FDX).

Democrats argue that the Inflation Reduction Act will help tame inflation because it dampens medical and energy costs while paying for itself.

Earning Warnings:

NVIDIA CITES SHORTFALL IN REVENUE PRIMARILY DRIVEN BY WEAKER GAMING – Not surprising given gaming’s correlation to Covid lockdowns was high. The company is still high on my conviction list given it’s a leader in a secular growth industry of the future.

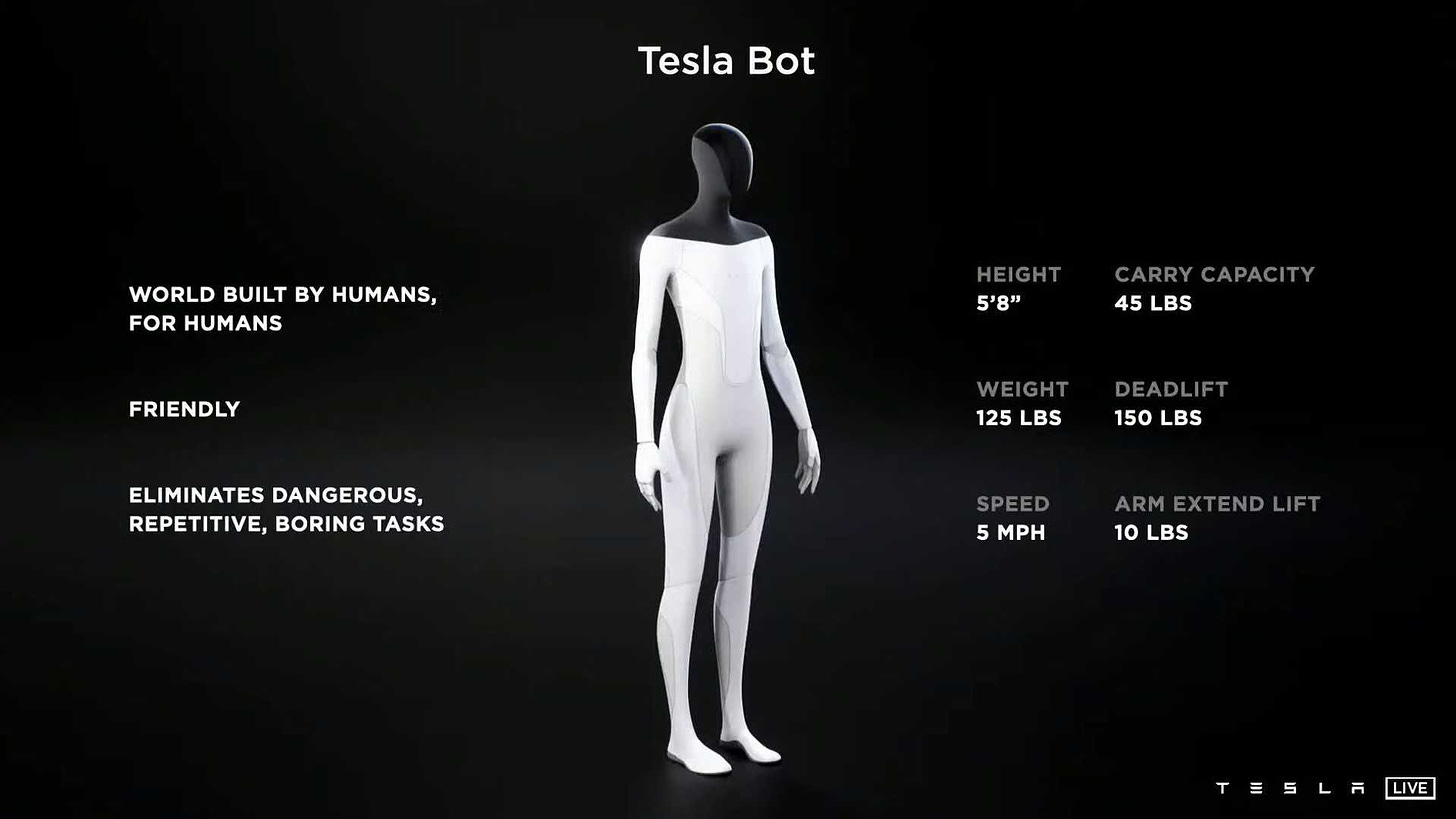

One for the Calendar - Sept 30th – TESLA - AI Day – OPTIMUS ROBOT

“I’m sort of surprised that people—or you know, like, analysts out there are not really understanding the importance of the Optimus robot,” said Musk. “In fact, I think it will turn the whole notion of what’s an economy on its head.”