Chat GPT is as Great an Advancement as the Internet – according to Bill Gates:

Bill Gates said this week that Chat GPT is as significant as the introduction of the internet, so I would advise reading up on its capabilities if you haven’t already.

Google vs Microsoft Search Battle continues to heat up:

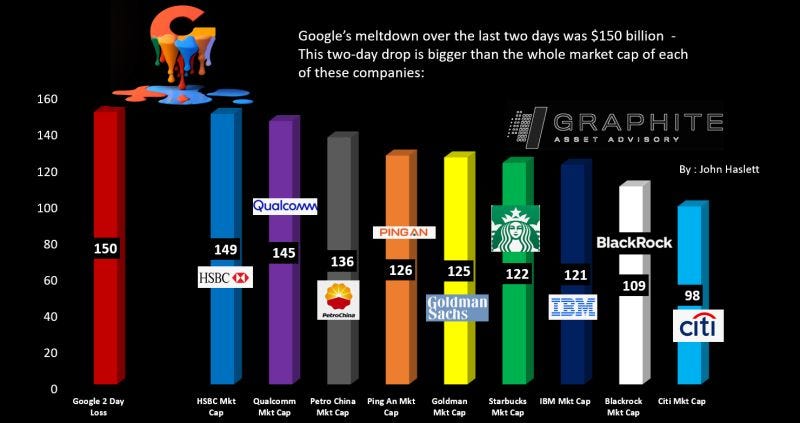

After Microsoft’s successful introduction of Chat GPT, Google announced their response to a human answering chat box by the name of Bard. However, it embarrassingly answered a question incorrectly on its launch day which lead to a monstrous 2 day sell off of 150 billion, equaling the market cap of some household names seen below:

Chinese firms Alibaba and Baidu have also announced they are launching something similar this week.

Next Market Direction is All Dependent on CPI!

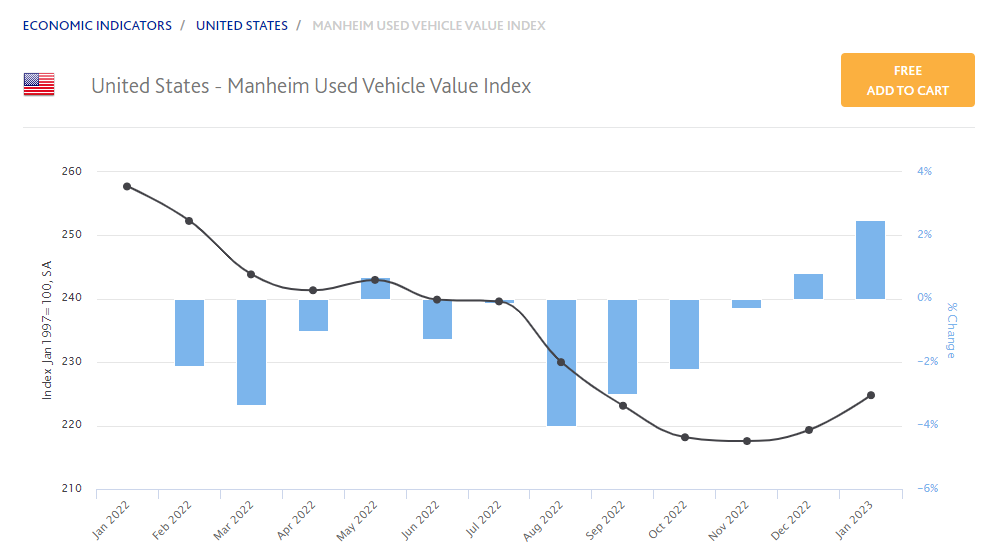

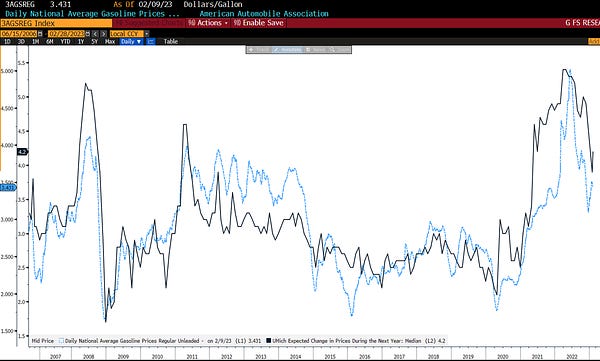

Volatile sideways trading is likely until next CPI release next Tuesday. There is conflicting data on the future pathway of inflation now that the easy moves have been made. The Manhiem index (car price data) is pointing to surging prices again, in contrast to the negative prints for the last few months. Similarly, the Adobe Online Price Gauge a well-respected tool for measuring online prices for goods highlighted an uptick in prices for January compared to December. It could be argued that these moves are seasonal e.g. less Black Friday sales impacting pricing in January and the rush to buy new car in the new year and the long term downward trend will continue afterwards. These data points are weakening the thesis of a soft inflation backdrop and reinforcing fears that the FED will have to hike higher and for longer.

However, listening to companies earnings calls they are still reporting cooling inflation tailwinds. Paypal, L’oreal and Chipotle all mentioned softening inflation signs on their earnings calls over the last few days.

Softer inflation will mean less hiking from FED and likely increase in equity prices. After the blowout labour market results last Friday Jerome Powell was measured in his comments speaking on Tuesday, he reiterated the deflation process had started and he expected inflation to come down significantly this year. In contrast his board members took a more hawkish approach saying rates will need to get above 5% before they finish hiking cycle. If inflation does not continue downward trajectory, I will have to revise up my March FOMC interest rate prediction from 0% to 0.25%, in line with consensus.

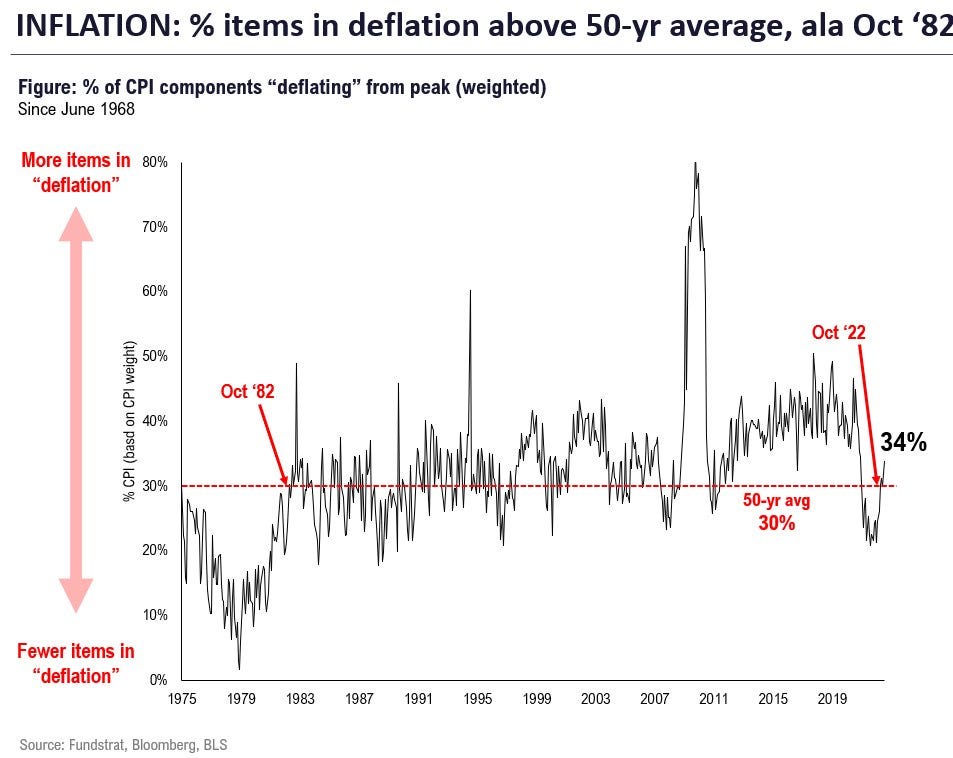

Here's an interesting comparison to the inflation in the 70s. When greater than 30% of CPI items were in deflation Volker ended “fight against inflation”. We have similar conditions today:

Best proof is 34% of CPI basket (by weight) is in outright deflation

- 50-yr avg 30%

- Back in 80s, this figure did not rise above 30% until Oct '82

- Guess when Volcker ended inflation war? Hint: Oct '82

This figure crossed above 30% in Oct '22...Hint: inflation war over

Click here for more details:

A non-inflation risk to watch out for is:

Russia is expected to launch to counter offensive –Impact on European Equities and the energy markets particularly likely if we see ramp up in conflict.

Companies Earnings

Uber:

Uber Technologies Inc. reported revenue that beat analysts’ estimates, suggesting rising inflation hasn’t kept consumers from ordering more takeout or hailing a ride. The shares jumped about 6% in premarket trading.

Revenue rose 49% to $8.6 billion in the fourth quarter, the San Francisco-based company said Wednesday in a statement. That beat the $8.5 billion analysts had projected, according to data compiled by Bloomberg. Gross bookings, which encompass ride hailing, food delivery and freight, increased 19% to $30.7 billion, in line with estimates.

“We ended 2022 with our strongest quarter ever, with robust demand and record margins,” Chief Executive Officer Dara Khosrowshahi said in the statement

In comparison its major competitor Lyft was down 30% after earnings release.

WEDBUSH: After “22 years on the Street.. last night’s $LYFT call was a Top 3 worst call we have ever heard .. a debacle for the ages. We are downgrading from OUTPERFORM to NEUTRAL as .. There are serious questions around if Lyft's business model can scale from here ..

Long term business model thoughts:

Uber gaining market share here. While good for Uber I am not a major fan of ride hailing business model. Its very low margin business and subject to the economic cycle. Significant costs will come out when we get to autonomous driving but that is a lot way away yet to factor into valuation yet.

Cost Cutting continues to be rewarded in the Tech Sphere:

PayPal with a double beat + raises guidance. Acting CFO: "Our 2022 results demonstrate the ongoing progress we are making to optimize our cost structure while continuing to invest in our high-conviction initiatives..."

Disney CEO on cost-cutting: "We are targeting $5.5B of cost savings across the company... in general, the savings will come from reductions in SG&A & other operating costs across the company. To help achieve this, we will be reducing our workforce by approximately 7,000 jobs"

Adidas down 11% after reporting weak 2023 outlook and may need to take a large hit on Yeezy stock after discontinuing relationship with Kanye West after he made antisemitic comments.